A Limited Liability Partnership or LLP is one of the most flexible and founder-friendly business structures you can choose in India. It is perfect for consultants, small service firms, professionals, NRI entrepreneurs and even family-run setups. LLP registration in India gives you the comfort of limited liability, smooth compliance, easy management and the credibility you need to work with clients in India and abroad. You can register your LLP completely online in 8 to 10 days, and we are trusted by more than 5,000 founders and NRI entrepreneurs across the world.

An LLP is ideal for consultants, service firms, CAs, CSs, IT professionals, agencies, freelancers, and NRI entrepreneurs. With Limited Liability Partnership registration, founders can start operations quickly without the pressure of strict corporate requirements. The entire LLP registration online process takes 8–10 days, and more than 5,000 founders trust our team every year. This guide breaks down the Limited Liability Partnership Act 2008, the documents required, FEMA rules, timelines, and the LLP registration process in simple, human language.

What is a Limited Liability Partnership in India?

If you are an NRI, foreign founder or even an Indian entrepreneur looking for a simple, flexible and low-maintenance structure, an LLP is one of the easiest ways to start and manage a business in India.

- Limited liability protection for partners: Your personal assets stay safe. Even if something goes wrong, you only risk the amount you contribute to the LLP. This makes LLP incorporation a solid choice for entrepreneurs who want legal protection without heavy compliance.

- Flexible management structure: No strict corporate rules. No heavy compliance like a private limited company. Everything runs as per your LLP Agreement, making the structure simple and easy to manage.

- Ideal for consulting, services, family businesses and global collaborations: Perfect for IT, consulting, digital marketing, CA/CS services, small agencies, and global collaborations. This makes LLP registration online a top choice for founders wanting simplicity.

- Cheaper and easier annual compliance: LLPs do not need a compulsory audit unless they cross a certain turnover. ROC filings are minimal, straightforward and very cost-effective compared to companies.

- Credible and globally accepted: Banks, multinational companies and international partners recognise LLPs as a reliable and professional business structure, making it easy to build trust.

Who Should Choose an LLP?

An LLP is a great fit for entrepreneurs who want the flexibility of a partnership with the protection of limited liability. You should choose an LLP in India if:

- You want low compliance and easy maintenance:

LLPs have fewer filings, simple rules, and smoother LLP incorporation compared to a private limited company.

- You’re a small business, startup, consultant, or service provider:

Ideal for CA/CS firms, IT services, marketing agencies, designers, freelancers, trainers, and professional partnerships.

- You want limited liability without heavy regulations:

Partners are protected from business risks, but without the strict corporate structure of a company.

- You’re a founder trio/duo looking for flexible ownership:

LLPs allow you to decide profit-sharing ratios freely, without linking them strictly to capital.

- You want to bring in NRIs or foreign partners: FDI in LLPs is allowed in many sectors, and remote registration makes it easier for global partners.

- You prefer a structure that’s credible yet budget-friendly: LLPs offer legal recognition and trustworthiness without high compliance costs.

- You don’t plan to raise venture capital: If fundraising from VCs or issuing equity isn’t your priority, an LLP is perfect.

Who Can Register an LLP in India?

Whether you are an NRI, a foreign entrepreneur or an Indian resident, registering an LLP in India is simple and accessible. The rules are straightforward, and most of the process can be completed online with minimal paperwork.

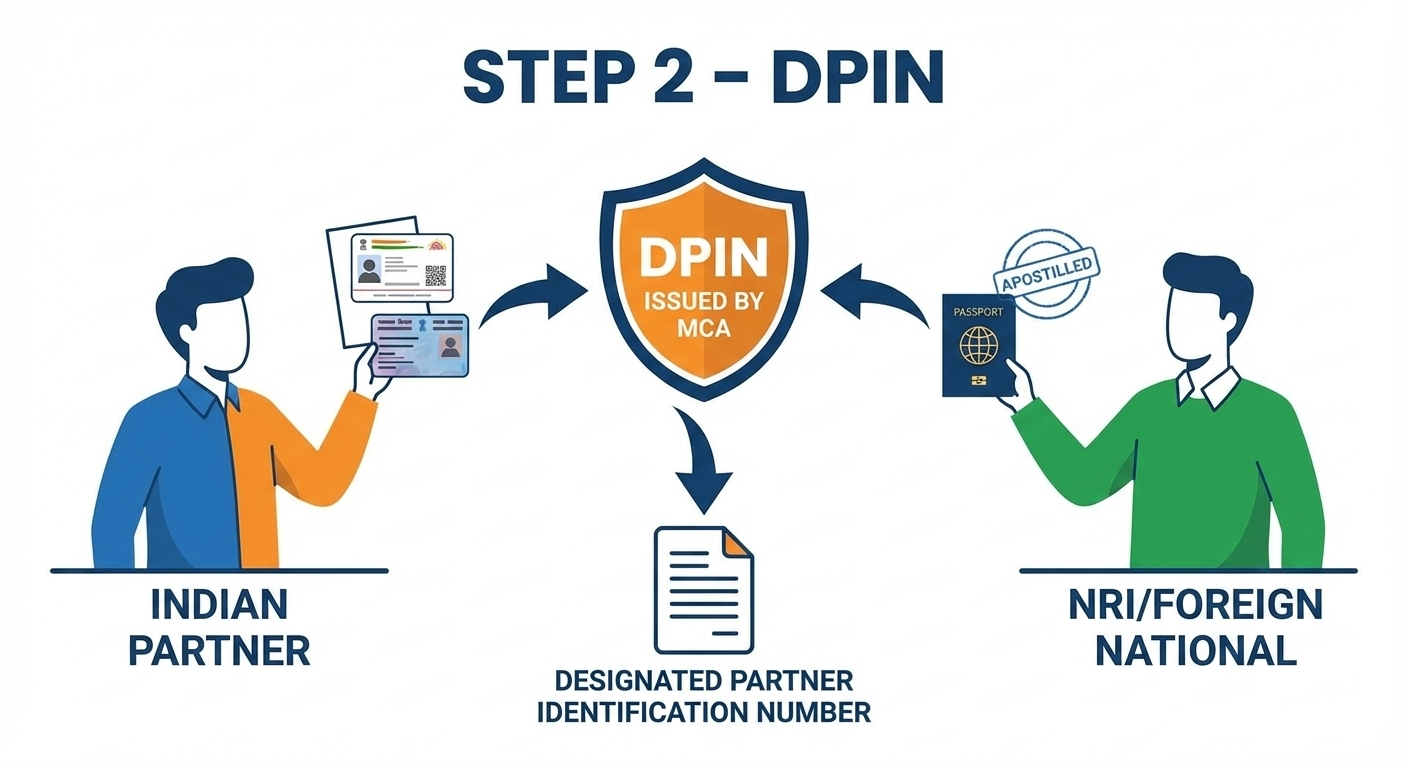

For NRIs and Foreign Nationals

- You are fully eligible to start or join an LLP in India and can hold ownership and management roles without restrictions.

- There must be at least one partner who stays in India, ensuring smooth compliance and day-to-day coordination with authorities.

- Any foreign investment must follow FEMA rules. For most service-based sectors, the process is simple and usually falls under automatic approval.

- Everything can be completed remotely. Digital signatures, documents and filings can all be handled online from your home country.

- Foreign documents need proper verification. Once notarised and apostilled or consulate attested, they are fully acceptable for LLP registration online.

- Your investment must come through approved banking channels to maintain clean compliance and proper FDI reporting.

For Indian Residents

- An LLP must have at least two partners at the time of incorporation.

- No minimum capital requirement You can start your LLP with any amount. There is no compulsory minimum investment.

- LLPs enjoy fewer regulations, no mandatory audit below a certain turnover and much lower annual compliance costs compared to companies.

- Right from DSC to final filing, the entire LLP registration is completed online, making it fast and hassle-free.