Introduction

Whether you are an Indian citizen, NRI, or a foreign national, Taxlegit helps you to understand what is a section 8 company registration online is, managing end-to-end documentation, licences, foreign KYC, and post-incorporation compliances such as 12A, 80G, CSR filings, and FCRA support.

What is a Section 8 Company in India?

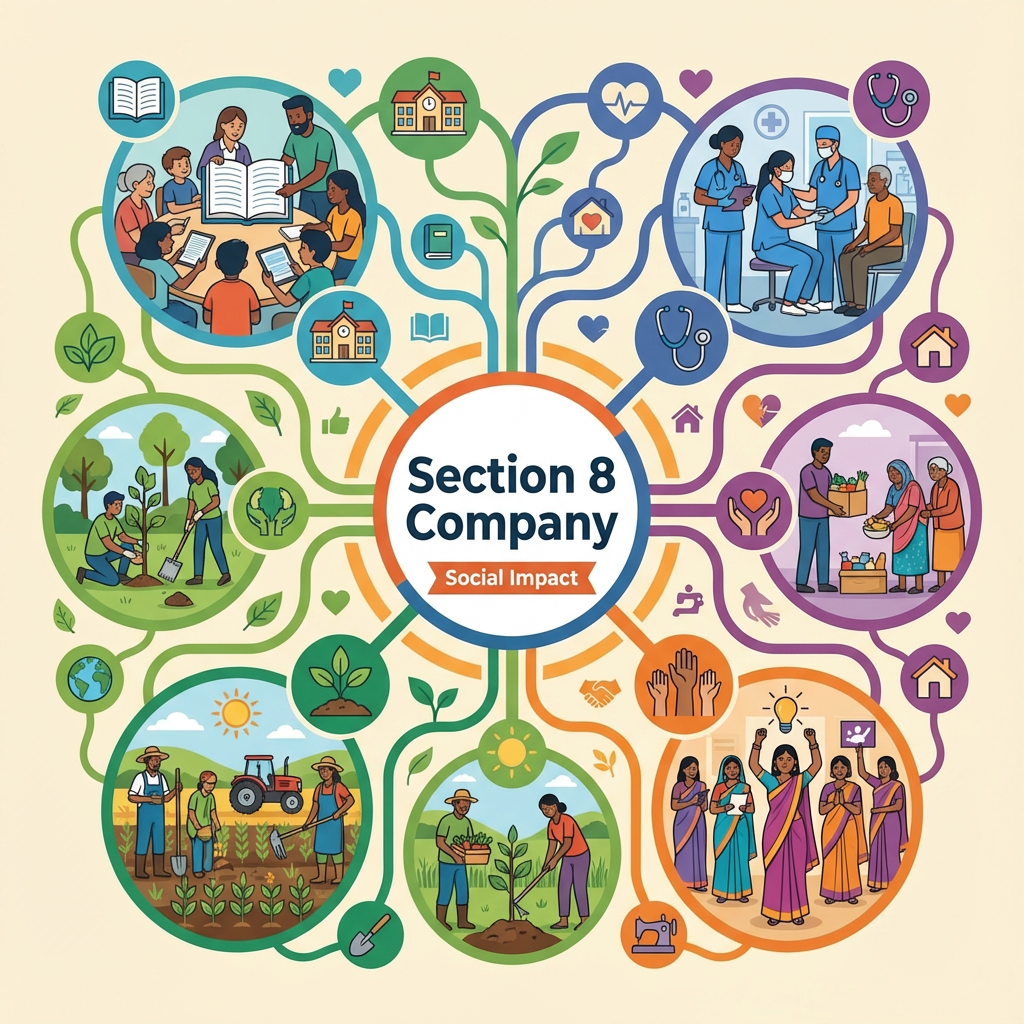

A Section 8 Company is a registered non-profit organization created to support meaningful social and charitable causes. These organizations operate without any intention of profit distribution, and through Section 8 Company Registration, they are required to use every rupee of their income strictly for social development work. They cannot share dividends with members, which makes them one of the most trusted Section 8 companies in India for donors and CSR partners. Anyone who wants to build a long-term impact initiative can easily begin their journey through the section 8 company registration online, ensuring a credible and fully compliant structure. Allowed Objectives of the section 8 company incorporation procedure:

- A Section 8 Company can work in multiple domains, including:

- Education and skill development

- Poverty relief and welfare of the weaker sections

- Healthcare, hospitals, medical aid

- Environmental protection & sustainability

- Research, art & culture promotion

- Rural development, livelihood enhancement

- Women's empowerment, human rights & social justice

- Any other activity covered under social welfare

Difference: Section 8 Company vs Trust vs Society

| Feature | Section 8 Company | Trust | Society |

| Legal Status | Highest (Companies Act) | Medium | Medium |

| Registration Authority | MCA | State/Registrar of Trusts | Registrar of Societies |

| Suitable For | CSR funding, national NGOs, foreign donors | Small NGOs | Community groups |

| Governance | Strict, transparent | Flexible | Flexible |

| Credibility | Very High | Medium | Medium |