Company Registration

Which Type of Company Should Foreigners and NRIs Open in India?

February 11, 20266 mins44 views

Foreigners and NRIs usually choose between Private Limited Companies, Liaison Offices, and Limited Liability Partnerships (LLPs) in India. In 2026, Private Limited Companies remain the gold standard; they offer the best blend of 100% ownership control, ease of raising VC funds, and streamlined compliance, making them the preferred choice for 90% of foreign investors.

Overview

Entering the Indian market in 2026 can be exciting as it's fast and rewarding, but you really need to know which carriage to board. Foreign investors and NRIs often face a common dilemma: which type of company in India is best suited for their business goals and compliance ease? We get it. The fear of "getting it wrong" is real. Choosing the wrong structure doesn't just mean extra paperwork; it can lead to missed tax holidays, restricted ownership, or a compliance mountain that's hard to climb. At Taxlegit, we’ve seen brilliant ideas stall because of a mismatched legal foundation. Think of this guide as your GPS for the Indian corporate landscape.

By the end of this blog, you’ll have a clear framework to decide which company type suits your needs, understand the 2026 compliance essentials, and know why your choice of city actually matters.

Choosing the Right Type of Company in India for Foreigners

Choosing the right entity is your first strategic move. Foreign nationals can register businesses in India under the Foreign Direct Investment (FDI) rules, with no prior government approval required, only post-investment reporting to the RBI. This makes India a foreigner-friendly destination for startups, but you'll need at least one Resident director in India (staying 182+ days/year) and must comply with sector-specific caps. Here's a simple breakdown of options, pros, cons, and tips for non-residents.

Private Limited Company:

- 100% FDI automatic in most sectors (e.g., IT, manufacturing, e-commerce); ideal for scaling or raising funds.

- Quick setup via SPICe+ form; needs 2 directors/shareholders (one India-resident).

- Tip: Perfect for a virtual office and local director; no minimum capital required.

Public Limited Company:

Best for big ambitions, like listing on stock exchanges (NSE/BSE).

- Allows unlimited shareholders but heavier compliance (audits, disclosures) and minimum ₹5 lakh capital.

- FDI follows the same automatic route as Pvt Ltd in most cases, but overkill for startups due to costs, and at least 3 directors are needed.

- Tip: Skip unless planning IPO soon; start with Pvt Ltd and convert later.

Limited Liability Partnership:

A flexible hybrid blending partnership is easy with company-like, cheaper ongoing compliance than companies.

- FDI allowed only in sectors with 100% automatic FDI and no performance conditions (e.g., manufacturing, not sectors like telecom).

- Automatic routes are possible, but more scrutiny is required than in companies.

- Tip: Good for services/consulting abroad; needs 2 partners (one India-resident).

Liaison/Branch Offices:

Non-full business setups for foreign parent companies without any equity investment needed, but RBI approval is required.

- Liaison Office: Only Market research is required; no sales or contracts are needed with a fixed tenure now (per 2025 RBI updates).

- Branch Office: Limited projects in permitted sectors (e.g., exports) are allowed where profits can be repatriated with the RBI regime.

- Tip: Use as a low-risk test; needs parent net worth of USD 50k+ and security clearance if from certain countries.

| Option | FDI Ease | Min. Members/Directors | Best For | Drawbacks |

| Pvt Ltd | 100% automatic (most sectors) | 2/2 (1 resident) | Start-ups, scaling | Moderate compliance |

| Public Ltd | Automatic (most) | 7/3 | Stock listing | High costs |

| LLP | Automatic (select sectors only) | 2/2 | Services | FDI limits |

| Liaison/Branch | RBI approval | N/A | Market entry | No full trading |

Start with Pvt Ltd for flexibility. Consult a CA/CS for your sector, get DIN/DSC remotely, and use portals like MCA.gov.in. For any further assistance, you can book a free consultation from Taxlegit.

Understanding The Indian Company Law and Regulations

- Companies Act, 2013: It is the foundation for incorporating and managing your business.

- Foreign Exchange Management Act (FEMA): The RBI’s rulebook on how you bring money in and take profits out.

- Income Tax Act, 1961: Defines your "Tax Bill" (and the 2026 exemptions).

- Ministry of Corporate Affairs (MCA): Where your company is "born" digitally via the V3 portal.

- Reserve Bank of India (RBI): The gatekeeper of Foreign Direct Investment (FDI).

Top Benefits for Global Founders Entering India in 2026

India's rules now focus on welcoming businesses, not just regulating them. Here's the 2026 edge:

- 100% Automatic FDI in Key Sectors: No RBI approval needed for IT, manufacturing, and renewable energy (DPIIT Consolidated FDI Policy 2025). Invest fully and start fast.

- Cloud Services Tax Break: Foreign firms offering cloud services through Indian data centers get a tax holiday until March 2047 (Budget 2025 extension under Section 80JJAA).

- No Double Taxation (DTAA): Tax treaties with 90+ countries (e.g., USA, UK, Singapore) prevent paying tax twice on the same income (Income Tax Act, updated 2026 list).

- 5-Year Tax Exemption for Experts: New in 2026: Foreign specialists on approved projects skip tax on non-Indian income for 5 years (Finance Act 2026, notified sectors like tech/R&D).

- One-Stop Digital Clearances: National Single Window System (NSWS) links 32+ departments for instant approvals (live since 2021, expanded 2026 per MCA).

These benefits cut setup time by 50% and costs by 30% (World Bank Ease of Doing Business 2025 data). Ideal for scaling globally.

Practical Checklist for Foreign Company Registration

- Verify your business sector's FDI rules on the DPIIT website to confirm automatic route eligibility.

- Get all foreign identity documents (like passports) notarized and apostilled in your home country for legal recognition in India.

- Obtain Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) for all directors, including foreign ones (can be done remotely).

- Reserve a unique company name via the MCA portal, ensuring it doesn't conflict with existing trademarks or registered entities.

- Get the documents apostilled for the foreign director.

- File the SPICe+ "All-in-One" form (2026 version) for incorporation, integrating MoA, AoA, and initial registrations.

- Receive PAN and TAN automatically issued along with your Certificate of Incorporation.

- Submit RBI FDI reporting (Form FC-GPR) within 30 days of receiving foreign investment funds.

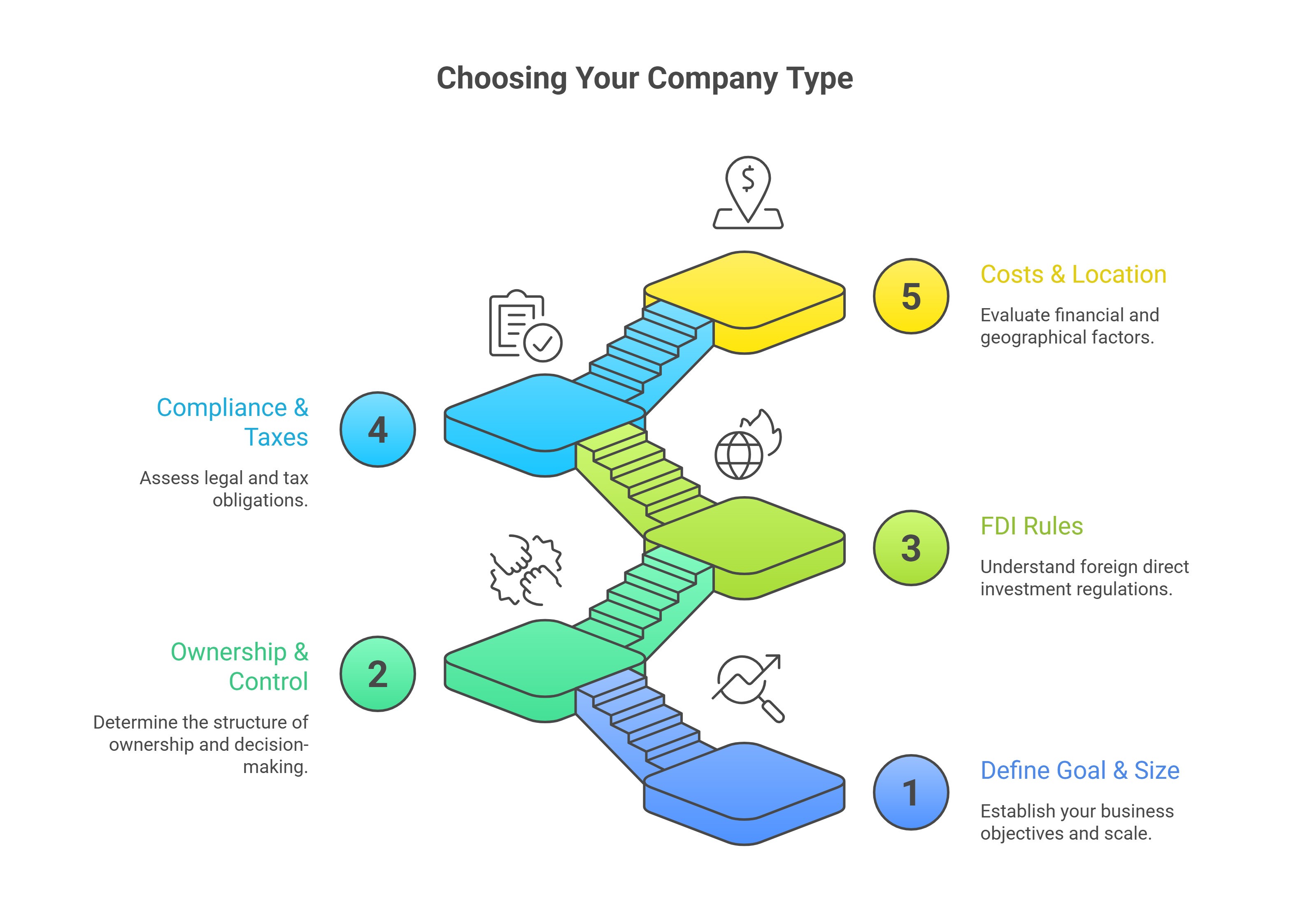

Step-by-Step Guide to Choose Your Company Type

Step 1: Define your goal and size:

Build a big business like a unicorn with a Private Limited. Test the market without sales using a Liaison Office.

Step 2: Think about ownership and control:

Private Limited gives full control from your home country. It requires just two directors, with one as a local nominee.

Step 3: Check FDI rules for your sector

IT, manufacturing, and e-commerce allow 100% automatic approval. Defense and media require government approval.

Step 4: Weigh compliance and taxes

Private Limited requires mandatory audits. LLPs offer less maintenance but limit investments.

Step 5: Factor in costs and location

Big cities like Delhi, Mumbai, and Bengaluru provide speed at higher costs. Smaller cities like Pune and Coimbatore cut rent and offer local tax benefits.

FEMA Compliance & Banking Infrastructure

Once your company is born, the money trail must be legal. In 2026, the RBI’s FIRMS Portal is the only way to report foreign money coming into India.

FEMA & Banking Checklist

- FC-GPR Filing: Reporting the initial capital infusion to the RBI within 30 days of issuing shares.

- KYC of Foreign Remitter: Your foreign bank must provide a "Know Your Customer" report to the Indian receiving bank.

- Capital Inflow Account: A specialized bank account designed to receive "Foreign Direct Investment."

- PAN/TAN for Foreign Directors: Even if you don't live in India, as a director of an Indian company, you need an Indian Tax ID (PAN).

Common Mistakes Foreign Investors Make

- The "Assume 100%" Trap: Assuming every sector allows 100% FDI. Always check the DPIIT guidelines first.

- The "Late Reporting" Penalty: Forgetting to file the FC-GPR form with the RBI after you bring in capital. In 2026, the penalties for this are non-negotiable.

- Treating a Liaison Office like a Shop: Using a Liaison Office to generate revenue is a legal "red card."

- Underestimating "Resident Director" KYC: Every Indian company needs one director who stays in India. Their KYC must be spotless, or your incorporation will bounce.

The Master Roadmap: Your 30-Day Entry Plan

Entering a new country shouldn't take months. Here is the Taxlegit-accelerated timeline for 2026.

| Timeframe | Key Activities |

| Week 1 | Document Prep: Collect KYC from overseas; Initiate Apostille/Notarization in your home country. |

| Week 2 | Digital Identity: Apply for Foreign Director DSC (Video KYC) and DIN. Name reservation via SPICe+ Part A. |

| Week 3 | Incorporation Filing: Submit SPICe+ Part B, e-MoA, and e-AoA. Integration of PAN/TAN and EPFO. |

| Week 4 | RBI & Banking: Open the Corporate Bank Account; Remit initial capital; File Form FC-GPR with RBI. |

Real Case Study: German Firm's Smart Switch in Bengaluru

In early 2025, our team at Taxlegit consulted for a German tech startup eyeing the Bengaluru market. They planned to launch an AI tool for sustainable farming and wanted to keep setup costs low, so they initially favored a Limited Liability Partnership (LLP).

We reviewed their goals: quick market entry, plans for foreign debt financing, and scaling with investors. Fact-check: Under India's Companies Act 2013 and FEMA regulations (updated RBI guidelines as of 2025), LLPs face strict limits on foreign borrowing, which delays processes by 3-6 months. Private Limited companies, however, allow easier equity funding and debt via automatic FDI routes up to 100% in IT/agri-tech sectors (DPIIT green list).

After explaining these hurdles with real RBI data and precedent cases (e.g., similar startups blocked on LLP debt), they pivoted to Private Limited via SPICe+ incorporation. Total cost: ₹15,000-20,000, done in 7 days.

Outcome - Six months in (August 2025), they secured $2M in seed funding from European VCs that is smoothly routed as FDI. Today, they're hiring 20+ staff and expanding to North East India. Lesson: Match structure to funding needs early to avoid roadblocks.

This case highlights why 70% of foreign tech entries choose Pvt Ltd (MCA stats, FY24-25).

Conclusion

Setting up in India is no longer a bureaucratic nightmare; it's a strategic masterstroke. However, the 2026 rules around "Place of Effective Management" (POEM) and FEMA reporting mean you need a partner who speaks both "Global Business" and "Indian Law."

At Taxlegit, we don't just register your company; we set up your tax structure, handle your RBI filings, and ensure your first year is audit-proof.

Frequently Asked Questions ( FAQs )

Q1. Can I be a 100% owner of an Indian company as a foreigner?

Yes, In most sectors (Tech, E-commerce, Manufacturing), 100% ownership is allowed via the "Automatic Route."

Q2. Do I need to travel to India for registration?

No, In 2026, the entire process, including DSC video verification, can be done remotely from your home country.

Q3. What is the minimum capital I need to bring in?

There is no "minimum" amount required by the Companies Act, but you must bring in enough to cover your initial business expenses and authorized capital.

Q4. How is my global income taxed?

If you are a non-resident director, only the income you earn from the Indian company (salary or sitting fees) is taxed in India. Your global income remains safe under DTAA protections.