News and Updates

Indian Union Budget 2026-27: Everything You Need to Know

February 3, 20266 mins64 views

Quick Summary

On February 1, 2026, Finance Minister Nirmala Sitharaman presented India's Union Budget 2026-27 in Parliament, marking a historic moment as her ninth consecutive budget presentation. This budget sets the financial roadmap for the nation, with total expenditure of ₹53.5 lakh crore, and focuses on three key 'Kartavyas' (duties): accelerating economic growth, fulfilling people's aspirations, and ensuring inclusive development across all regions.

Think of the budget as your household expenses on a massive national scale. Here are the key numbers you should know:

- Total Expenditure: ₹53.5 lakh crore – This is how much the government plans to spend in 2026-27.

- Non-Debt Receipts: ₹36.5 lakh crore – Money the government expects to collect through taxes and other sources.

- Fiscal Deficit: 4.3% of GDP – The gap between what the government spends and what it earns, down from 4.4% in 2025-26.

- Capital Expenditure: ₹12.2 lakh crore – Investment in infrastructure, roads, railways, and long-term projects (an 11.5% increase from last year).

- Debt-to-GDP Ratio: 55.6% – The total government debt as a percentage of the economy, showing a declining trend from 56.1% last year

The New Income Tax Act 2025: What Actually Changes

The Income Tax Act 2025 replaces the 64-year-old Income Tax Act of 1961, effective April 1, 2026. This is India's largest direct tax reform, designed to simplify compliance without changing tax rates or slabs.

Updated ITR Filing Deadlines (FY 2025–26)

| ITR Category | Old Deadline | New Deadline |

| Salaried (ITR 1 & 2) | July 31 | July 31 |

| Business (Non-Audit) | July 31 | August 31 |

| Audit Cases | Oct 31 | Oct 31 |

| Revised Returns | Dec 31 | March 31 |

According to the official Press Information Bureau release, these numbers reflect the government's commitment to fiscal discipline while maintaining strong investment in growth sectors.

Need Expert Help Understanding How Budget 2026 Affects Your Taxes?

Taxlegit's certified tax professionals provide personalised budget impact analysis and tax optimisation strategies. Our experts help you:

- Maximise tax savings under the new Income Tax Act 2025

- Navigate ITR filing with extended deadlines and simplified forms

- Claim all eligible deductions and exemptions for FY 2026-27

- Optimise investment strategies based on the latest tax provisions

What Changes Under the New Income Tax Act 2025?

- Zero Changes to Tax Slabs & Rates: All existing income tax rates remain completely unchanged. So no taxpayer will pay more or less tax due to this reform

- Simplified ITR Forms: New income tax return forms redesigned for clarity with plain language, logical flow, and user-friendly formatting, reducing filing errors.

- 50% Reduction in Legal Sections: The new Act consolidates provisions, eliminates redundancies, and reduces complexity from 820+ sections to approximately 400 sections

- Unified 'Tax Year' Concept: Eliminates confusion between 'Previous Year' and 'Assessment Year' so that income earned in FY 2026-27 will be taxed in 'Tax Year 2026-27'

- Modern Legal Language: Replaces archaic terminology with contemporary vocabulary, making tax law accessible to average taxpayers without constant legal interpretation.

The Ministry of Finance announcement confirms this reform is designed to enhance taxpayer convenience, reduce litigation, and improve compliance through simplified procedures while maintaining revenue neutrality.

What's changing:

- Tax slabs remain the same – No changes to income tax rates

- Simpler forms – New ITR forms will be easier to understand and fill out

- 50% fewer sections – The new law cuts down complexity by nearly half

- Single 'tax year' concept – No more confusion between assessment year and previous year

Important Tax Relief Measures:

- ITR Filing Deadlines Extended: Salaried individuals (ITR-1 and ITR-2) can now file by July 31. Business taxpayers get until August 31.

- Revised Returns: You can now file revised returns until March 31 (extended from December 31) with just a nominal fee.

- TCS Reduction on Foreign Education: Tax collected at source for education abroad drops from 5% to 2%.

- Medical Treatment Abroad: TCS was also reduced to 2% from 5% under the Liberalised Remittance Scheme.

- Tour Packages: TCS on overseas tour packages slashed to 2% from the earlier 5-20%.

As confirmed by the Ministry of Finance, these changes aim to reduce the compliance burden and improve the ease of living for taxpayers.

Manufacturing & Economic Growth: Building a Stronger India

The budget puts significant focus on making India a global manufacturing hub. Here are the major initiatives:

Biopharma Shakti Initiative:

A massive ₹10,000 crore investment over five years to develop India as a global biopharma manufacturing hub. This includes:

- Setting up 1,000 accredited clinical trial sites across India

- Establishing 3 new National Institutes of Pharmaceutical Education and Research (NIPER)

- Upgrading 7 existing NIPER institutions

India Semiconductor Mission 2.0

₹40,000 crore allocated to strengthen semiconductor manufacturing, including equipment, materials, design, and developing a skilled workforce.

Other Manufacturing Initiatives

- Container Manufacturing Scheme: ₹10,000 crore over five years to boost domestic container production

- Textile Sector: Integrated program covering natural fibres (silk, wool, jute) and man-made fibres

- 200 Legacy Industrial Clusters: Revival and modernisation of traditional manufacturing hubs like Jalandhar and Meerut

Infrastructure Investment: Building India's Future

The government continues its strong push on infrastructure with record investments:

Railways & Transportation

- ₹2,77,830 crore allocated to the Ministry of Railways for capital expenditure

- Seven high-speed rail corridors planned as 'Growth Connectors' between major cities

- New dedicated freight corridor between Dankuni (West Bengal) and Surat (Gujarat)

Defence Modernization

Defence budget increased to ₹7,84,678 crore (from ₹6,81,210 crore last year), with:

- ₹2,19,306 crore for capital expenditure

- ₹63,733 crore for aircraft and aero engines

- ₹25,023 crore for naval fleet expansion

Infrastructure Risk Guarantee Fund

A new fund will be established to strengthen private developers' confidence in infrastructure projects by providing risk guarantees during development and construction phases.

Social Welfare & Regional Development

Healthcare Initiatives

- AYUSH Ministry budget increased by 20% to ₹4,408.93 crore

- Three new All India Institutes of Ayurveda to be established

- NIMHANS-2 to be set up in North India

- National Mental Health Institutes in Ranchi and Tezpur to be upgraded

Education & Skills

- One girls' hostel to be established in every district for STEM institutions

- 15,000 secondary schools and 500 colleges to get Content Creator Labs for the Orange Economy (creative industries)

- 10,000 tourist guides to be upskilled through IIM collaboration

Sports Development

- Khelo India Mission launched with a 10-year vision to transform grassroots sports

- Focus on sports manufacturing to make India a global hub for sports goods exports

Regional Focus: Purvodaya & North-East

- East Coast Industrial Corridor with Durgapur as a connected node

- 5 new tourism destinations in the 5 Purvodaya states

- 4,000 e-buses for the region

- Buddhist Circuit development scheme for North-Eastern states

Agriculture & Rural Development

- Bharat-Vistaar: A multilingual AI tool to integrate Agristack portals and ICAR agricultural practices

- Self-Reliant India Fund: Additional ₹2,000 crore to support micro enterprises

- Lakhpati Didi Scheme: Expanded to support 3 crore women entrepreneurs

Expert Analysis & Economic Projections

As per the Economic Survey, this Budget 2026-27 has been characterised as "historic" and emphasised it establishes a "strong foundation for high flight toward a developed India by 2047" through balanced growth, fiscal responsibility, and inclusive development.

Kotak Mahindra Bank Founder Uday Kotak praised this as "a budget for the real economy", highlighting substantial defence spending increases and maintained fiscal discipline despite global economic uncertainties.

The Economic Survey 2026 projects India's GDP growth at 6.8-7.2% for FY 2026-27, driven by strong domestic consumption, sustained capital formation, and gradual recovery in private investment despite global headwinds from geopolitical tensions and monetary tightening in developed economies.

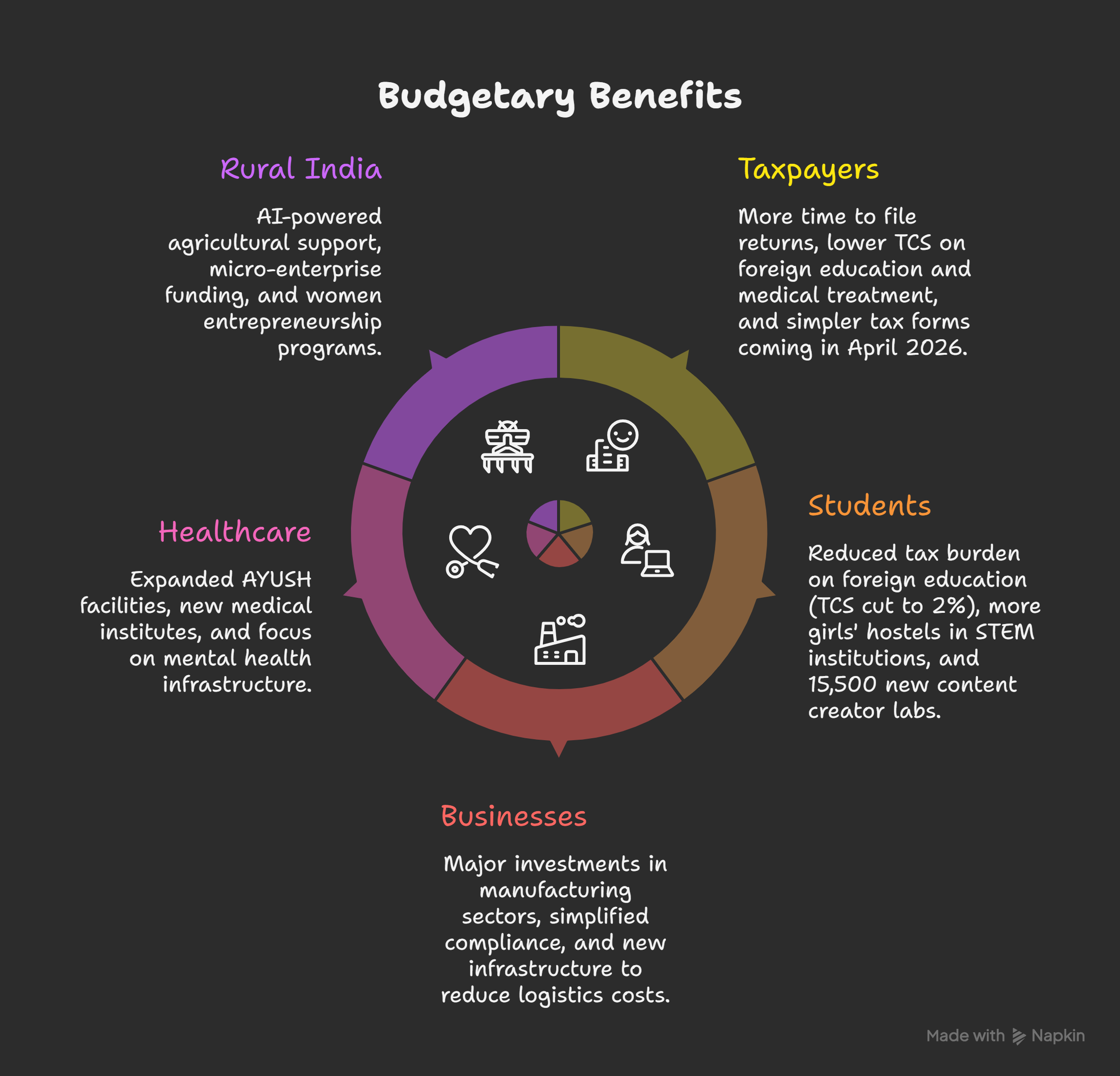

Key Takeaways: What This Budget Means for You

- For Taxpayers: More time to file returns, lower TCS on foreign education and medical treatment, and simpler tax forms coming in April 2026.

- For Students: Reduced tax burden on foreign education (TCS cut to 2%), more girls' hostels in STEM institutions, and 15,500 new content creator labs.

- For Businesses: Major investments in manufacturing sectors, simplified compliance, and new infrastructure to reduce logistics costs.

- For Healthcare: Expanded AYUSH facilities, new medical institutes, and focus on mental health infrastructure.

- For Rural India: AI-powered agricultural support, micro-enterprise funding, and women entrepreneurship programs.

- For Infrastructure: High-speed rail corridors, expanded metro networks, better freight connectivity, and modernised defence capabilities.

Action Planning Checklist for FY 2026-27

- Review Tax Regime Choice: Recalculate whether the old tax regime (with deductions) or the new tax regime (lower rates) benefits you more under the Income Tax Act 2025

- Optimise Section 80C Investments: Max out ₹1.5 lakh deduction through ELSS, PPF, NSC, life insurance, or principal repayment if using the old regime

- Plan Foreign Education Remittances: Take advantage of the reduced 2% TCS rate – time remittances strategically to minimise upfront tax collection

- Utilise Extended Filing Deadlines: Don't rush ITR filing, rather use the full deadline (July 31 for salaried, August 31 for business) to ensure accuracy

- Document All Deductions: Maintain digital records of Section 80D (health insurance), 80G (donations), 80E (education loan interest) for substantiation

- Explore Manufacturing Opportunities: Business owners should evaluate PLI schemes in biopharma, semiconductors, and textiles for expansion plans

- Consult Tax Professional: Complex situations (capital gains, rental income, foreign assets, business income) require expert guidance to minimise liability

The Bottom Line

Union Budget 2026-27 represents a balanced approach between fiscal discipline and growth. With a fiscal deficit target of 4.3% of GDP and capital expenditure at a record ₹12.2 lakh crore, the government is betting on infrastructure-led growth while maintaining financial prudence.

The new Income Tax Act 2025 promises to make compliance easier for millions of Indians, while sector-specific initiatives in biopharma, semiconductors, and manufacturing aim to position India as a global production hub.

How Taxlegit Helps You Act on Budget 2026–27

Budget changes create opportunities, only if you know how to leverage them. Taxlegit's expert CA team comes with comprehensive tax services that include:

- Personalised Tax Planning: Custom strategies for salary, business income, capital gains, and rental income

- Complete ITR Filing: All ITR forms (1-7) with maximum refund and zero penalties

- TCS Optimisation: Minimize tax on foreign education, medical treatment, investments, and luxury purchases

- GST Compliance: Registration, monthly/quarterly filing, reconciliation, and audit support

- Business Advisory: Company registration, accounting, payroll, statutory compliance, and CFO services

- Notice Response: Expert handling of income tax notices, scrutiny, and appeals

FAQs ( Frequently Asked Questions )

Q1. What is the new "zero tax" limit for salaried individuals?

Under the New Tax Regime, if your annual salary is up to ₹12.75 lakhs, you effectively pay zero income tax. This is possible because the standard deduction is ₹75,000 and the tax rebate (Section 87A) has been increased to ₹60,000.

Q2. When does the "New Income Tax Act, 2025" actually begin?

While it was passed in 2025, the New Income Tax Act officially comes into effect on April 1, 2026. It aims to simplify the 60-year-old tax code with easier language and faster digital filing processes.

Q3. How will the 'Biopharma SHAKTI' scheme affect me?

This scheme (outlay of ₹10,000 crore) focuses on making India a hub for biologics and biosimilars. For the common man, this means lower costs for high-end treatments.

Q4. What is 'Bharat VISTAAR' and who is it for?

Bharat VISTAAR is a new multilingual AI tool for farmers. It combines data from "AgriStack" (digital land records) and ICAR research to give farmers personalised, real-time advice on their mobile phones regarding weather, soil health, and pest control.

Q5. Who are 'Corporate Mitras' and how do they help MSMEs?

'Corporate Mitras' are a new cadre of trained professionals (like CAs and Company Secretaries) stationed in Tier-II and Tier-III towns. Their job is to act as mentors for small business owners, helping them with paperwork, compliance, and getting loans without the usual "red tape" headaches.