Company Registration

Private Limited Company Registration in India: The Ultimate 2026 Guide

February 17, 20265 mins6 views

Setting up a Private Limited Company in India can be a great option for entrepreneurs looking to build a scalable, credible, and legally secure business. Whether you are a local founder or an NRI looking to tap into one of the world's fastest-growing economies, private limited company registration in India offers the perfect balance of operational flexibility and investor trust.

As your company transitions from a closely-held venture to a public-facing entity, it can no longer afford to operate with a board that is just a group of friends or family. Registering a private limited company in India provides the formal structure required to attract venture capital, protect your personal assets, and comply with the Companies Act, 2013.

What is a Private Limited Company in India?

A Private Limited Company (Pvt Ltd) is a voluntary association of at least two members that has a separate legal identity. It offers "limited liability" to its shareholders, meaning their personal assets are protected if the company faces financial distress.

Why is it the Preferred Structure for NRIs and Indian Business Owners

For NRIs, it allows for 100% Foreign Direct Investment (FDI) in most sectors through the automatic route. For Indian owners, it provides a "corporate veil" that separates personal and business risks, making it far superior to a sole proprietorship or partnership.

Why Choose a Private Limited Company?

- Limited Liability: Your risk is limited to the amount of share capital you contribute. Your personal house, car, and savings are safe.

- 100% Foreign/NRI Ownership: Under 2026 FDI norms, most sectors (like IT, E-commerce, and Manufacturing) allow NRIs to own the company entirely without prior government approval.

- Separate Legal Identity: The company can own property, enter into contracts, and sue (or be sued) in its own name.

- Easier Funding & Credibility: Banks and VCs prefer Pvt Ltd structures because of the transparency required by the Ministry of Corporate Affairs (MCA).

- Perfect for Global Expansion: It is the easiest Indian entity to integrate with global holding structures.

Who Can Register a Private Limited Company in India?

For NRI/Foreigner:

- Ownership: NRIs/Foreign nationals can be 100% shareholders and directors.

- Resident Director: At least one director must be a resident of India (staying in India for 182+ days in the previous financial year).

- No Travel Required: The process is 100% digital. NRIs do NOT need to visit India for registration.

- Authentication: All foreign documents must be notarised and Apostilled (or consulate-attested) in the home country.

- Investment: Share capital must be received via a valid foreign inward remittance (FIRC).

For Indian Residents:

- Mandatory: At least one Indian director with a valid Aadhaar and PAN.

- Capital: There is no minimum paid-up capital requirement (you can start with ₹1,000).

- Compliance: Enjoy a streamlined setup with minimal physical documentation.

Eligibility Criteria for Incorporation Private Limited Company in India

| Feature | For NRIs / Foreign Residents | For Indian Residents |

| Min. Directors | 2 (1 must be an Indian resident) | 2 |

| Min. Shareholders | 2 | 2 |

| Digital Signature (DSC) | Mandatory (Foreign/Apostilled) | Mandatory |

| Director ID (DIN) | Mandatory | Mandatory |

| Registered Office | Must be a physical address in India | Must be a physical address in India |

Documents Required for Registration

Documents Required from NRIs / Foreign Shareholders:

- Passport: Must be valid, notarised, and apostilled.

- Foreign Address Proof: Utility bill or bank statement (not older than 60 days).

- Photograph: Recent passport-sized photo.

- Indian PAN: Not mandatory if you don't have one, but highly recommended for future tax filings.

- Board Resolution: Required if a foreign company is the shareholder.

Documents Required from Indian Directors:

- PAN Card: Mandatory.

- Aadhaar Card: For identity verification.

- Address Proof: Bank statement or utility bill (Electricity/Water/Gas) not older than 60 days.

- Specimen Signature: On the prescribed form.

FEMA Compliance for NRI Investment

Setting up a Pvt Ltd company in India as an NRI involves the Foreign Exchange Management Act (FEMA).

- Inward Remittance: Capital must come through proper banking channels.

- Reporting: You must file Form FC-GPR with the RBI within 30 days of issuing shares.

- Proof: Keep your FIRC (Foreign Inward Remittance Certificate) or SWIFT copy safe, as banks require this for share allotment.

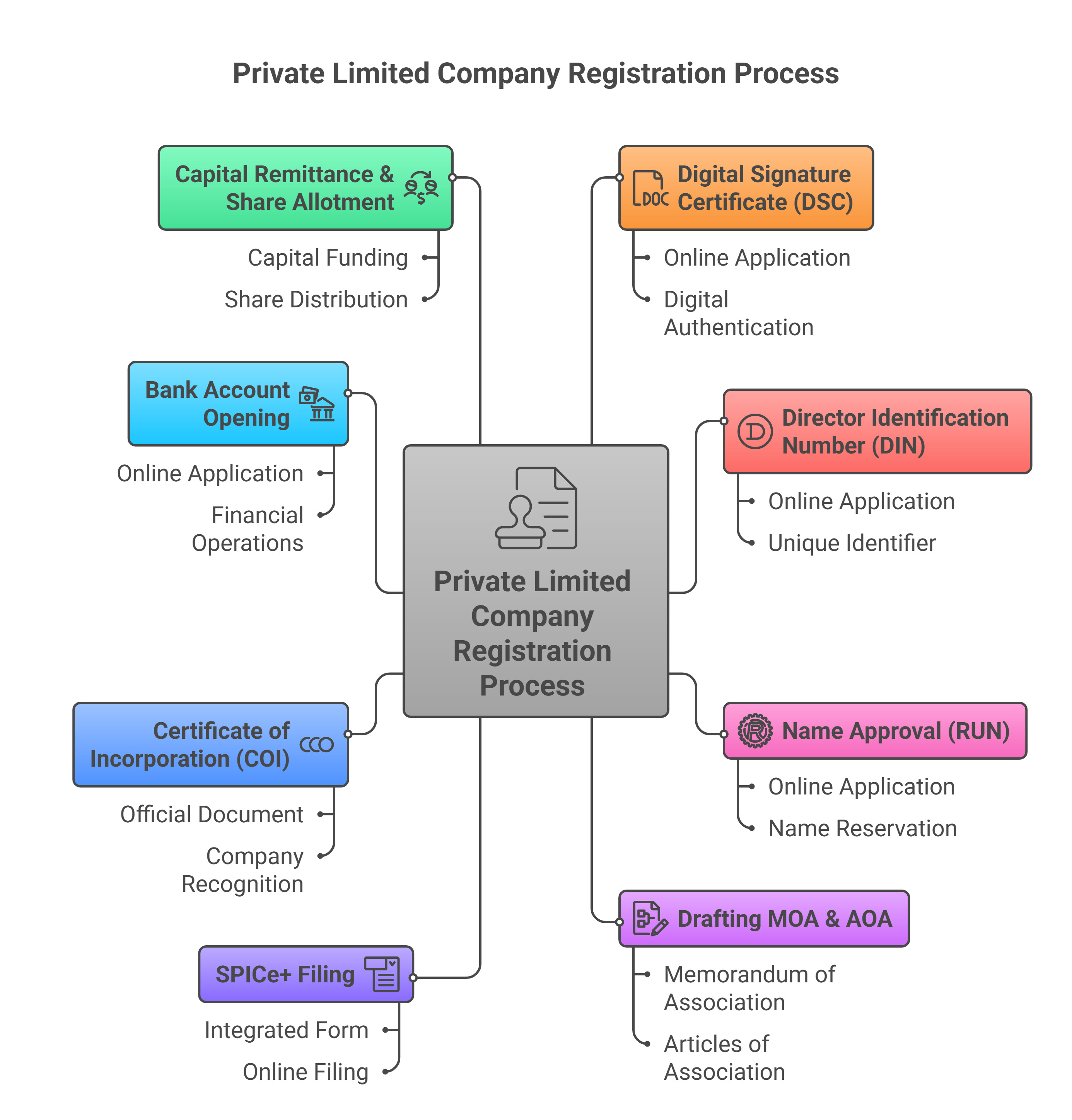

Step-by-Step Private Limited Company Registration Process

Step 1: Digital Signature Certificate (DSC)

Since the process is electronic, all directors need a DSC. For NRIs, the physical documents used for the DSC must not be notarised in their country of residence.

Step 2: Director Identification Number (DIN)

This is a unique 8-digit number assigned by the MCA. You can apply for this directly through the SPICe+ incorporation form.

Step 3: Name Approval (RUN)

You propose two names in order of preference. We perform a Trademark conflict check to ensure your name isn't infringing on existing brands.

Step 4: Drafting MOA & AOA

The Memorandum of Association (MOA) defines the company’s goals, while the Articles of Association (AOA) are the internal rulebooks. For NRIs, we include specific clauses to facilitate FDI.

Step 5: SPICe+ Filing

This is the "All-in-One" application. It includes:

- SPICe+ Part B: Incorporation details.

- AGILE-PRO: GST, EPFO, ESIC, and Bank Account application.

- e-MOA & e-AOA: Electronic versions of your constitution.

Step 6: Certificate of Incorporation (COI)

Once approved, the RoC issues the COI. Your PAN, TAN, and CIN (Corporate Identity Number) are auto-issued.

- Timeline: Usually 3–7 working days.

Step 7: Bank Account Opening

- For Indians: Standard KYC.

- For NRIs: Requires FATCA/CRS compliance and additional scrutiny related to the source of funds.

Step 8: Capital Remittance & Share Allotment

The final step is bringing in the capital. NRIs must ensure the money is transferred from their NRE/NRO/Foreign account to the new company account, followed by RBI reporting.

Post-Incorporation Compliance

Registration is just the beginning. To stay in the "Green Zone," every company must:

- Appoint an Auditor within 30 days.

- File Form INC-20A (Commencement of Business) before starting operations.

- Conduct Board Meetings (at least 4 times a year).

- Annual Filing: Submit financial statements (AOC-4) and Annual Returns (MGT-7).

Timeline of Registration

- DSC & DIN: 1-2 Days

- Name Approval: 1-2 Days

- Incorporation (COI): 3-5 Days

- Bank Account & FDI Reporting: 10-15 Days

Why do NRIs Prefer Taxlegit?

We understand the unique challenges of cross-border business.

- End-to-end support for apostille and notarisation.

- FEMA/FDI Experts to handle RBI reporting so you don't get penalised.

- 24/7 WhatsApp Support across all time zones.

- Zero-Travel Guarantee: We handle everything while you stay abroad.